As one of the largest cities in Texas, Houston has always been a powerhouse of economic development, making it an ideal place to relocate, thanks to a strong economy, attractive housing options and a cosmopolitan atmosphere. It’s no surprise to see people moving here in droves, making Houston one of the top moving destinations in the country. The great variety of employment fields and more affordable housing are the main drivers behind this trend.

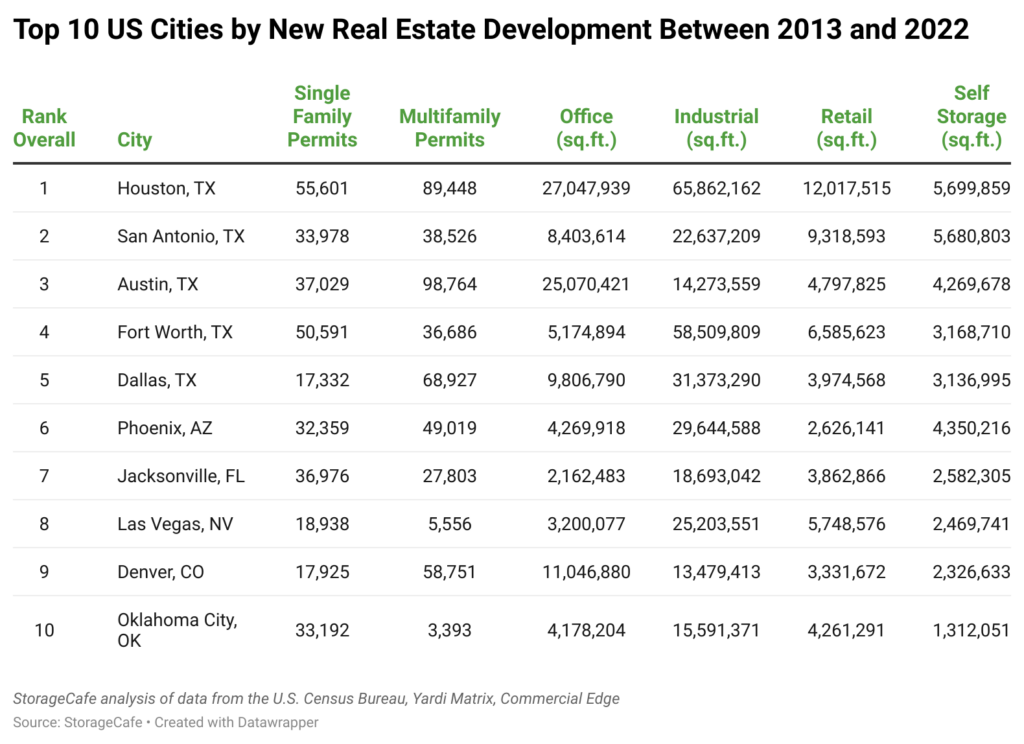

Increased migration coupled with a business-friendly environment created a fertile ground for booming construction across all real estate sectors. Therefore, Houston has been the most active real estate market for the last decade, based on a recent StorageCafe report investigating the topic. The report considered real estate construction across residential (single-family homes and multifamily), industrial, office, retail and self-storage in the top 100 cities by population. Based on the combined performance across all these sectors, Houston is the most active real estate market. San Antonio and Austin are second and third for overall construction, solidifying Texas’s position as the hottest state for real estate development across the decade.

Houston is number one in the country for single-family construction in the last decade.

As one of the most popular relocation destinations in Texas, Houston’s demand for housing skyrocketed, leading to an impressive 56K single-family homes permitted in the 2013 to 2022 decade. That makes Houston the most active market for home construction for this period. Construction peaked in 2021, with over 7K single-family home permits issued, seconded by 2022 when the city permitted 6.8K units. Throughout the decade, construction carried on consistently, with over 5K permits issued each year of the decade, except for 2016 when the city permitted about 4K single-family homes.

Besides Houston, Texas cities seem to dominate the single-family landscape for the decade, with four other cities in the national top five for single-family development. Fort Worth comes second after Houston with 50K homes, followed by Austin with over 37K single-family homes. El Paso, TX (20K permits); Dallas, TX (17K permits); and Lubbock, TX (14K permits), managed to position themselves among the top 20 cities nationally for their decade-long single-family development activity.

Houston to feature among the top 5 most active cities for apartment construction.

For the same time period, Houston has built close to 90K apartments based on permits, registering some of the most prolific construction activity in the country that caters to renters’ needs. Only New York City (238K permits), Los Angeles (117K permits) and Austin (99K permits) surpassed this construction volume — places that typically see constant demand for housing thanks to continuous migration.

Looking at the 2013 to 2022 period, Houston has seen exceptional construction levels throughout the decade, with all years seeing new permits issued in large numbers. However, it’s 2014 that stands out as a record year, with close to 15K apartments permitted then. In three other years, new apartment development was a little over 10K permits, including 2015, 2019 and 2020. Overall, Houston is second to Austin only for apartment construction volume in the state of Texas.

The commercial sector had a stellar decade in Houston.

Benefitting from the Texas business-friendly environment and lower taxes, Houston is also reaping the benefits of the economic boom that comes with such conditions, including construction supporting businesses. It’s no surprise construction in support of businesses, such as commercial real estate, is booming here, given that Houston is among the top ten places for startup formation, with over 9K of them recorded for 2021 alone. Among commercial classes, the industrial sector was the best performer in the country for the decade, while office, retail and self-storage came second in the country for construction volume.

Houston ranks #1 for industrial construction.

Thanks to the delivery of almost 65M square feet, Houston comes first nationally for industrial construction in the 2013 to 2022 decade. Each year of this period saw construction levels above 4M square feet. With about 10.5M square feet of industrial space delivered, 2020 was the most active year in this sector, even though 2014’s construction (9.5M square feet) was not far behind. As for 2021, when the pandemic still rippled through the country, industrial development slowed down, but Houston still saw about 3.4M square feet of space added to the local industrial inventory. Construction picked up the pace in 2022, registering a 55% annual growth as Houston delivered 5.3M square feet of industrial space.

At the state level, Fort Worth claims the second-highest volume of development for the decade – with 59M square feet of industrial space constructed — while Dallas, TX (31.3M square feet) takes the next spot.

Self-storage, office and retail each bring Houston the second spot nationally for a decade of construction.

Besides the industrial sector’s stellar performance, Houston also saw incredible construction volumes in the office, retail and self-storage sectors as the booming economy of the city further supported their expansion throughout the decade. Here’s how the three other commercial sectors performed:

Office construction: The office sectors delivered over 27M square feet of space over the course of the decade, with construction peaking in 2016 when Houston inventory increased close to 6M square feet of office space. Overall, the decade experienced strong office development activity, with several years seeing deliveries exceed 2M square feet. Consequently, with a healthy inventory in tow, industrial construction still continued in 2022, but at a more tempered pace, with only 843K square feet delivered.

Retail construction: Largely supported by a strong job market that allows people to use more of their discretionary income, the retail sector delivered a whopping 12M square feet of space during the 2013 to 2022 period in Houston. At the halfway point of the decade, intense activity surpassed 1M square feet, with construction peaking in 2017 when the city delivered 1.8M square feet. From 2019 to 2022, construction levels dove substantially, with 2022 recording the lowest delivery (338K square feet).

Self-storage construction: For the past decade, Houston added close to 5.7M square feet of self-storage space. Construction started on a more modest note at the beginning of the decade, with about 132K square feet of self-storage space delivered in 2013. But volumes went up in the subsequent years — so much so that 2018 brought a record 2.1M square feet of self-storage construction. In 2019, construction slowed down, but the local market still delivered over 1M square feet of self-storage space.

Overall, Houston has a healthy inventory of 26.7M square feet of self-storage, which boils down to 6.7 square feet per person. As far as pricing goes, renting a Houston, TX, storage unit costs $97/month.

Article provided by StorageCafe. For more information, visit www.storagecafe.com